Thnew 401k Hardship Withdrawal Rules 2024. Hardship withdrawal rule changes the act brings the hardship distribution rules for 403 (b) plans in line with those. Historically, such withdrawals were not only subject to income.

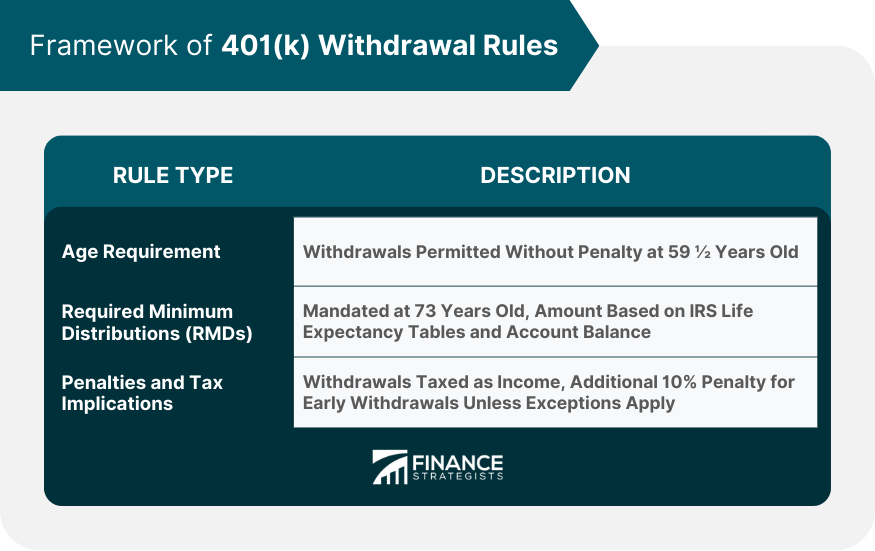

Under the new rules — which are part of the secure 2.0 retirement reforms — americans will be allowed one distribution (or withdrawal) per year of up to $1,000, and a taxpayer has the option. Based on the secure 2.0 act, roth 401 (k) account holders no longer have to take rmds.

The Irs Has Updated Guidance On 401K Hardship Withdrawal Guidance, Changing Plan Documents And Administration Rules To Clarify Procedures After Tcja.

For 401 (k) plans, both contributions and interest earned could be available for a hardship withdrawal.

This Rule Takes Effect In 2024, So You Must Still Take Rmds From Designated Roth Accounts For 2023.

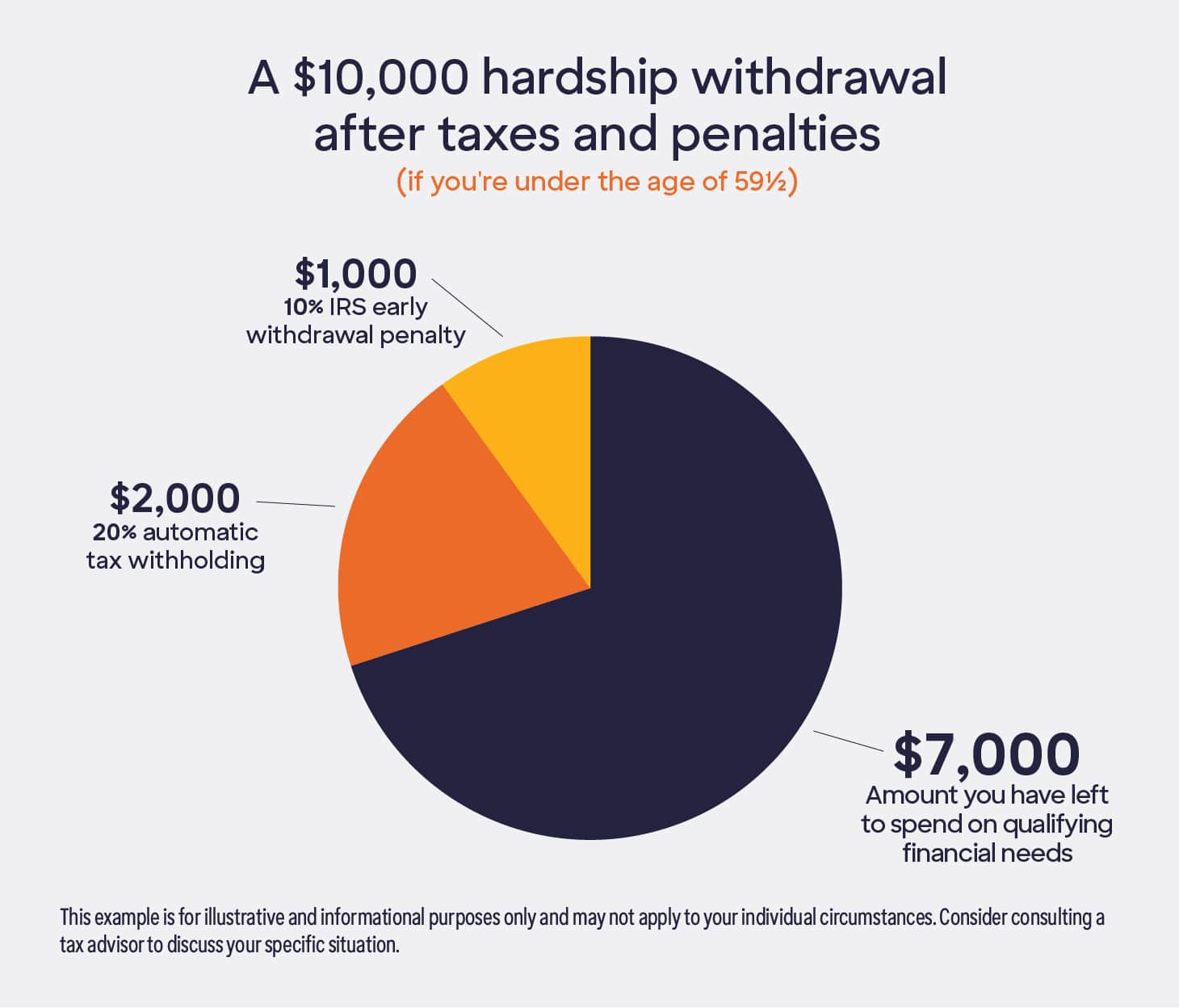

A 401 (k) hardship withdrawal is an early withdrawal that you might be able to take to cover specific expenses.

Thnew 401k Hardship Withdrawal Rules 2024 Images References :

Source: liliaswbride.pages.dev

Source: liliaswbride.pages.dev

New 401k Hardship Withdrawal Rules 2024 Fidelity Cara Marris, New irs rules are providing relief for individuals needing to make early withdrawals from retirement accounts due to emergencies. A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to.

Source: liliaswbride.pages.dev

Source: liliaswbride.pages.dev

New 401k Hardship Withdrawal Rules 2024 Fidelity Cara Marris, To make a hardship withdrawal, an employee must have already obtained any other income available under the 401k plan. Even if a new dad doesn't take the time off he deserves or is entitled to, every new father can build their schedules differently after a new child arrives.

Source: mungfali.com

Source: mungfali.com

401k Hardship Withdrawal Letter Sample, For 401 (k) plans, both contributions and interest earned could be available for a hardship withdrawal. If you do find yourself in a situation where it’s unavoidable to withdraw funds from your 401 (k) early, there is something called a 401 (k) hardship withdrawal that might allow you to access.

Source: www.youtube.com

Source: www.youtube.com

What qualifies as a hardship withdrawal for 401k? YouTube, While an emergency room bill would be considered eligible for a 401 (k) hardship withdrawal, a new car or vacation would not. Your employer can impose fees after that, but you'll still have access to your money.

Source: gbu-taganskij.ru

Source: gbu-taganskij.ru

401k Hardship Withdrawal Rules What Is It And Should You Do, 52 OFF, This rule takes effect in 2024, so you must still take rmds from designated roth accounts for 2023. For 401 (k) plans, both contributions and interest earned could be available for a hardship withdrawal.

Source: lslcpas.com

Source: lslcpas.com

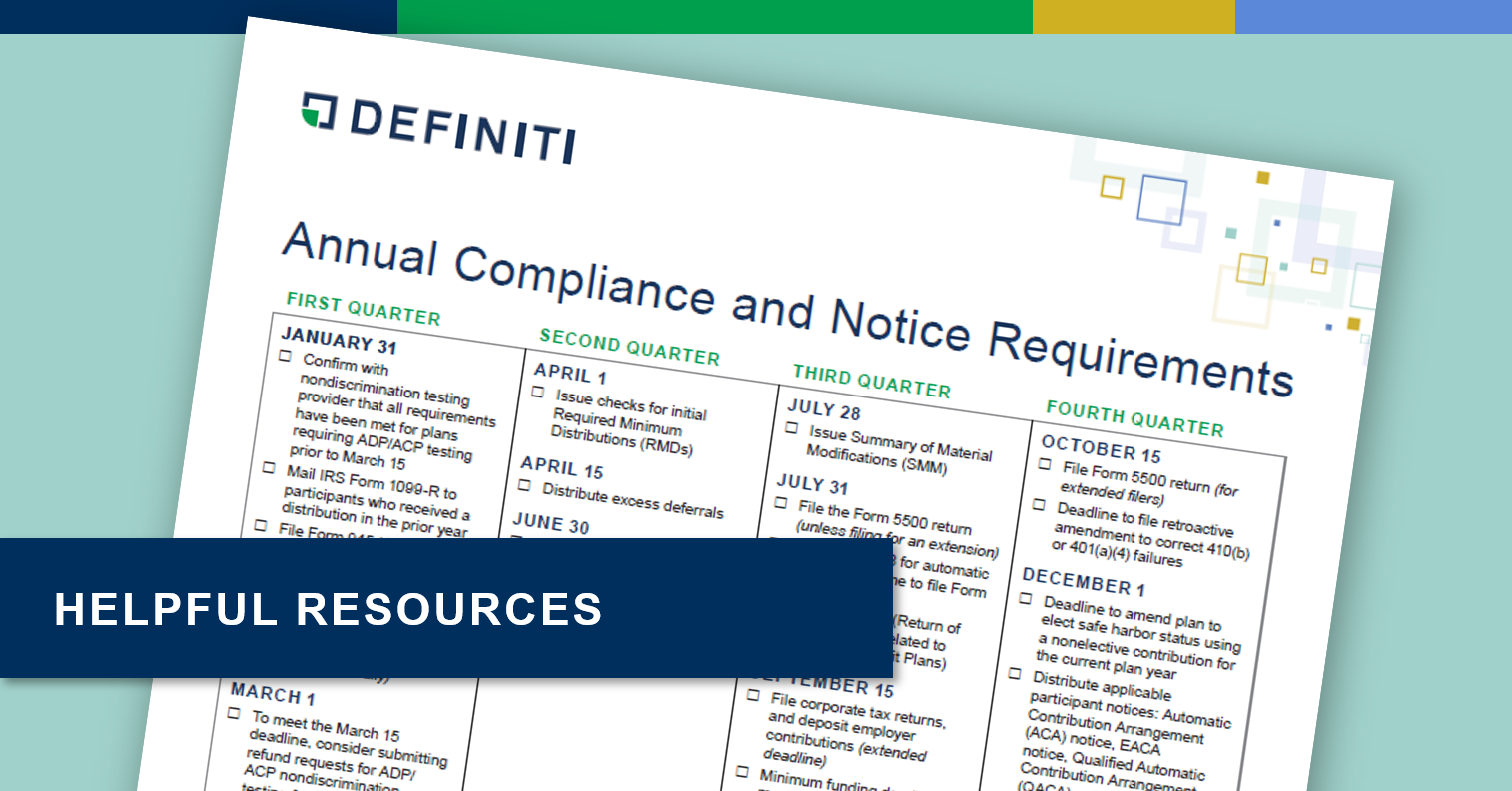

New 401k Plan Audit Rules for 2024 401k Audit Information, Making hardship withdrawals from 401 (k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new irs final rule. Under the new rules — which are part of the secure 2.0 retirement reforms — americans will be allowed one distribution (or withdrawal) per year of up to $1,000, and a taxpayer has the option.

Source: gbu-taganskij.ru

Source: gbu-taganskij.ru

401k Hardship Withdrawal Rules What Is It And Should You Do, 52 OFF, Your 401 (k) plan rules will determine if and when you’re allowed to take a. Normally, hardship distributions are taxable and may be subject to an additional 10% early distribution penalty if taken prior to age 59 1/2.

Source: gbu-taganskij.ru

Source: gbu-taganskij.ru

401k Hardship Withdrawal Rules What Is It And Should You Do, 52 OFF, New irs rules are providing relief for individuals needing to make early withdrawals from retirement accounts due to emergencies. Making hardship withdrawals from 401 (k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new irs final rule.

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

What Are The Irs 401k Limits For 2024 Sadie Collette, Making hardship withdrawals from 401 (k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new irs final rule. A 401 (k) hardship withdrawal is an early withdrawal that you might be able to take to cover specific expenses.

Source: www.youtube.com

Source: www.youtube.com

401(k) Hardship Withdrawal 101 Understanding the Rules and Regulations, This provision is effective for plan years beginning after december 31, 2024. Your employer can impose fees after that, but you'll still have access to your money.

The Irs States That You Can Qualify For A Hardship.

Making hardship withdrawals from 401 (k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new irs final rule.

But In Some Cases, 403 (B) Owners Experiencing Hardship May Be Limited To.

Hardship withdrawal rule changes the act brings the hardship distribution rules for 403 (b) plans in line with those.

Posted in 2024